The Bush administration reached an agreement with the mortgage industry on Wednesday on a plan to freeze interest rates for up to five years for a portion of the two million homeowners who bought houses in the last few years with subprime loans.[more] (Emphasis added.)

The plan, hammered out after weeks of talks among Treasury Department officials, mortgage lenders and Wall Street firms, would allow distressed borrowers who are current on their payments to keep their low introductory rates and escape an increase of 30 percent or more in their monthly payments when the rates expire.

Democratic lawmakers and presidential contenders quickly criticized the plan as being too timid and promoted more ambitious proposals of their own.

The agreement, to be formally announced Thursday by President Bush, is expected to contain numerous limitations that would exclude many — if not most — subprime borrowers, according to industry executives who have seen it. It would exclude those who are delinquent on their payments — about 22 percent of all subprime borrowers, according to First American LoanPerformance, an industry research firm.

Friday, December 07, 2007

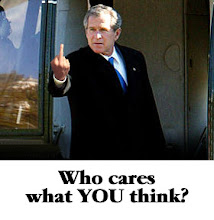

Our Leaders Fake Help For Subprime Borrowers

Um, and what about outlawing some of the more onerous practices of the lenders? Oh, wait, this is all about putting on a show of help....

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment